Shadow Stories for the Lending Industry Using Storyteller Tactics by Pip Decks

Banks and lenders are facing a difficult time under high interest rates. Could understanding the “shadow stories” in their industry provide insight to re-frame products and services?

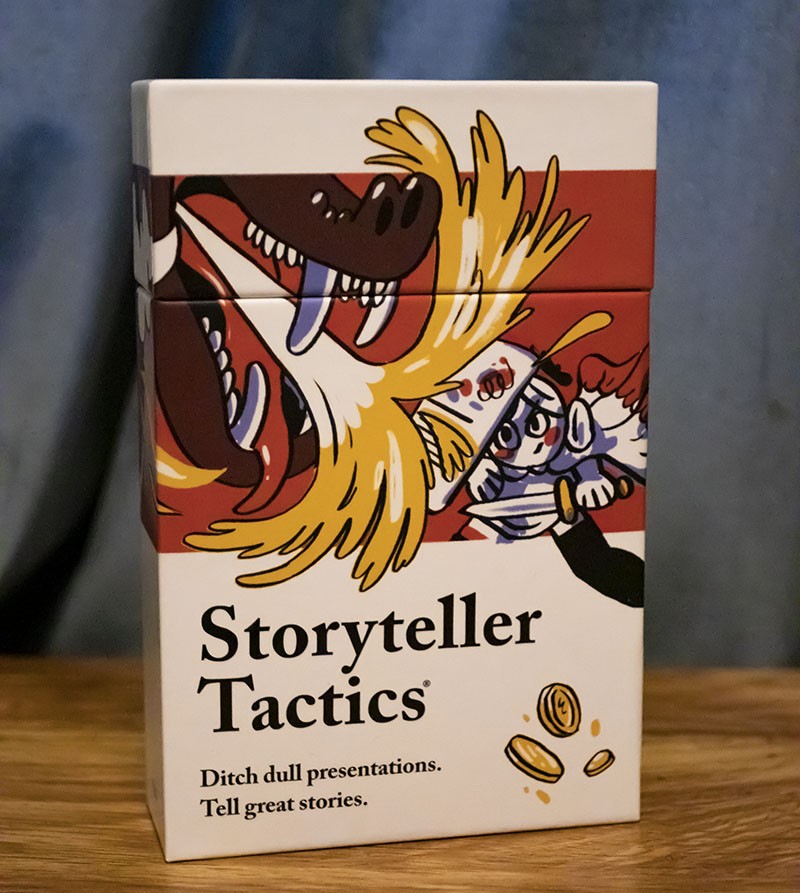

Click the image to follow my affiliate link. If this article is helpful, you can get THE ORIGINAL full set of Pip Decks, contribute something back here (I receive a small commission on each sale), AND get at 15% discount on your purchase. Ready to buy?

We all know what stories are, but what are Shadow stories? Here’s a quick example. On the cover of my Storyteller Tactics deck is a dragon. The hero is fighting the dragon, and generally, we want the hero to win and dragon to lose.

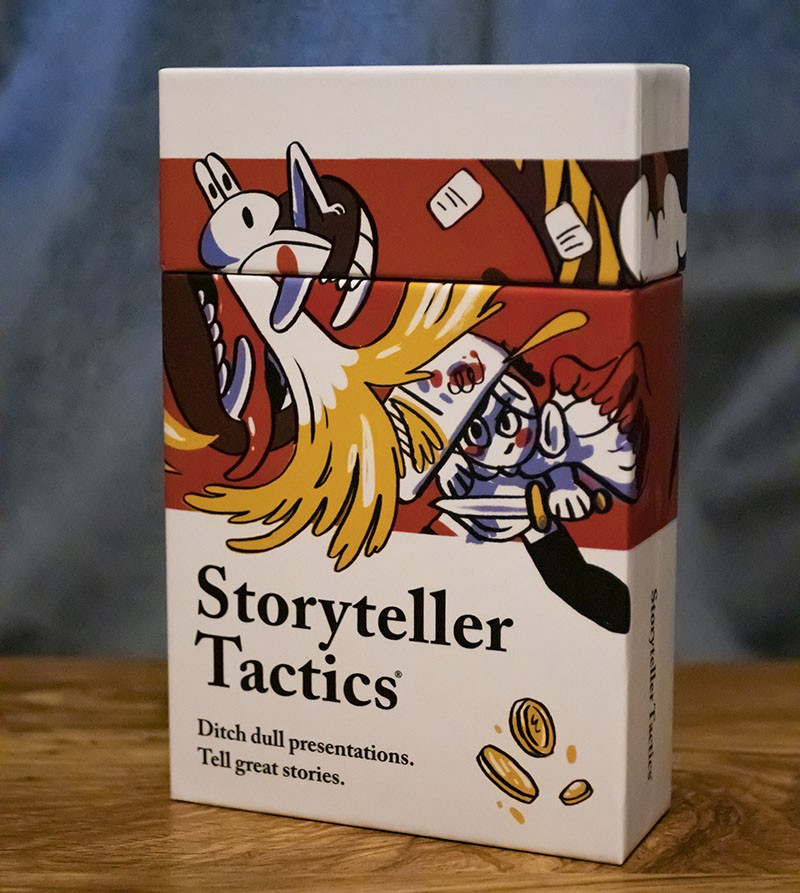

On the back are some characters in danger, caught up in the dragon’s tail. They are in fear and chaos.

What happens if we reverse the lid?

Our hero is getting his head bitten off and his blood and guts are squirting out everywhere. The cards that have our heroes plan are scattered to the winds, and the heroes trusty friend and confidant is fleeing.

In business branding today, it’s common to present your brand or company in the support role and your customer as the hero, but what happens when all of your guidance, products, services and insight merely lead your ‘hero’ customer to go and get their head bitten off?

The Storyteller Tactics deck is a set of 54 storytelling cards that are broken down into manageable story elements.

We generally exclude those possibilities from business consideration, but when we dig into this dark tale, we can identify powerful risks and opportunities for improvement that help our organization plan and implement strategies to manage or resolve these risks before they become a crisis.

Storyteller Tactics:

The idea of a “shadow self” comes from the psychological philosophy of Carl Jung. The idea is that there are components of our self that we accept and consider “who we are,” but there are also parts of our selves that we haven’t integrated. These could be personality traits, desires, emotions, and things we think or imagine that we don’t want to accept as part of who we are.

To look at stories and shadow stories, I like to go back to the tarot deck, the original storytelling deck, as it were. The tarot is made up of a number of archetypal characters (the major arcana) and journeys (the minor arcana). When someone gives a tarot reading, they invite someone to ask a question (often silently, in their mind), then draw cards randomly from the deck and place them into a pattern. Cards can be placed upright, but if they are drawn from the deck upside down they can carry an inverse meaning of the normal reading of the card.

Shadow Stories Can Anticipate a Downfall

So, loosely speaking, death could become life, wisdom could become navel gazing narrow mindedness. Joyful exploration could become risk taking and irresponsibility. When we use Storyteller Tactics we are a bit more planned in our approach. Though sometimes we do draw a random card to see if the business scenario can be framed within a random story concept, we can also strategize narrative arcs, which is the more common method.

I work with many people in the financial industry, and one of the biggest challenges they have is that there are many financial products available, but within each product category, say lines of credit, commercial real estate financing, or equipment financing, financing gets muddled in the mind of the consumer. There is, in fact, A LOT of nuance in each category, but most borrowers just want to pay a reasonable monthly payment and as low an interest rate as is possible. They see financing as a COMMODITY, not as something as unique as a brand – lenders are lenders. They just want their car, building, or video equipment.

What Do Commercial Lending Stories Look like?

The standard stories promoted in commercial financing can be described using the “Drive Stories” card from Storyteller Tactics deck produced by Pip Decks. This card focuses on the customer journey (i.e. the business owner). What drives them? These stories often focus only on the optimistic features of personal drive. Ad copy might read or sound something like this:

“You’re an independent business person with a passion for what you do. When it comes to capital you want the ease and flexibility that allows you to do business the way you like to, building relationships with your customers, hassle free.

“With (fill in the blank lender) you get easy transfers, a simple portal, and direct customer service from experienced lenders right in our state.”

Toss in some video clips of a small shop making unique things and selling them to a customer with a smile. You get the idea.

What Shadow Stories are Waiting in the Wings for Lenders?

This up-beat “drive” approach isn’t talking about interest rate, fees, or what happens if you miss a payment. There’s a lot of potential down side and risk to taking ANY borrowed money to pursue a dream – and that’s where the shadow features kick in. Your borrower could lose their car or home if they have to leverage assets to access the working capital. The interest rate could move faster than their ability to repay, and a good opportunity could be gobbled up in interest alone.

The shadow story is apparent: the borrower takes the easy money, but maybe production takes longer than anticipated and demand is either greater or less than projected. Everyone is stressed and customers and employees aren’t as happy as they were in the stock footage. The business owner has to take out more money from their line of credit than they thought they would, and in only a few months, the funds went from “tool of freedom” to “the bully that we work for.” Our independently minded business owners think to themselves, “I shoulda just bootstrapped it from the beginning.”

How Can Shadow Stories Change the Lending Industry?

A lender that is focused on supporting the stability of their borrowers could draw from these shadow stories by planning technology and service features that acknowledge and mitigate some of the risk factors, giving borrowers more transparency and more control.

A “shadow story” aware lender might create a message like this:

“You’re an independent business person, and that makes you think twice about taking money from easy lenders – the kind that want to make it look like dipping into your commercial line of credit is as easy as tapping a button on your phone. At (fill in the blank lender) we mitigate the risks associated with borrowing by showing you in real time how many payments it will take to repay what you’ve borrowed. We also provide a slider that demonstrates the cost of money based on how much you repay monthly. For businesses that find themselves in a pinch, our team conducts direct outreach to find out what occurred and to discover if there’s an alternate financing solution to resolve your situation. Our motto is ‘borrow smart and see your forecast in real time.’”

In a business context, this rich, dynamic tapestry of characters may be too complex, bogging down your story for audiences used to bullet points and metrics, so it makes sense that the full range of characters would be reduced in this deck.

Can Brand Stories Shape Products and Services?

It’s important to note that in this telling, the story features of the shadow story have actually INFLUENCED THE PRODUCT. In many product branding projects we have to think about the product itself as a character in the story that works its magic on behalf of the customer, empowering them as they go on their heroic journey.

When a business understands its “shadow stories” its’ better able to move its story platform to a Story Tactics card like “The Dragon and the City.” This story framework allows an organization to shift the conversation from commodity and price to something like a cause. The Dragon and the City is all about what has been built, what threatens what has already been established, and how the team of characters, including the provider, the customer, the products and the services work together to make the city better and safer than before the threat.

If a lending organization can say, “the threat is financing terms that sneak up on you and that aren’t transparent,” they can provide features that act as a guardian or protector so the “city” (the business that the borrower is trying to fund) can continue to grow, free from these threats. This might play out in the form of personal business finance advising or a financial health report card directly within the lender platform.

The lender could also empower the borrower to become the hero. If the lender can provide financial dashboard features, they put the borrower in the role of the hero. They are able to see risks and head them off at the pass with a range of financial choices and insights provided directly to the borrower.

How Can the Storyteller Tactics Deck Help the Lending Industry?

The Storyteller Tactics deck provides business owners, institutions and marketers a powerful set of proven story elements that mix and match seamlessly so that brands can adapt their story to unique customer demographics over time. You can read my review of the Storyteller Tactics deck, and if the tool looks like it could help your marketing, here is my affiliate link. You’ll receive a 15% discount, and I’ll make a small commission.

How can I get the most out of my physical Pip Deck cards?

Pip Decks are part of a larger trend in design thinking, teamwork, brand, and sales development that has developed since the 1990’s. Yes, the cards can be used quickly to strengthen tomorrow’s presentation, AND getting the most out of the decks means developing some knowledge and experience in the varied disciplines that have led to the emergence of Pip Decks.

Steve and the team at Pip Decks provide a bank of videos and Miro boards (a digital team white boarding platform) that help individuals or teams work through the discovery process to strengthen stories. In addition to purchasing a physical deck, you can get perpetual access to the Vault, an evolving set of tools you can come back to again and again.

What’s included?

- PDF version of the Storyteller Tactics for offline access

- Drag and drop digital cards for digital whiteboards

- Miro / MURAL templates for each Tactic so you can get started fast.

- Storytelling Video Tutorials, featuring 50+ coaching videos from author Steve Rawling.

- Access to all future Storyteller Tactics exclusive content, events and discounts.

Do you want to learn more about brand story development?

Take my online class The Brand Builder’s Workshop: The branding class for artists, small businesses and anyone who wants to make a big impact. It takes you from mission and vision through a comprehensive brand platform, and on to the implementation of a communications platform so you know what stories you want to tell, and to whom.